More oversight is needed if Cambodian banks are to weather the storm, says an IMF report. (Photo by: Heng Chivoan)

More oversight is needed if Cambodian banks are to weather the storm, says an IMF report. (Photo by: Heng Chivoan) Thursday, 12 February 2009

Thursday, 12 February 2009 Written by George McLeod

The Phnom Penh Post

Nonperforming loans could soar to 13 percent and reserves fall below limits if deposits and foreign capital continue to shrink, says new report

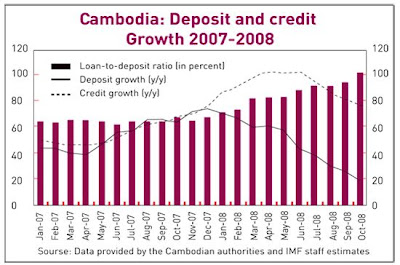

Cambodia's banks are under threat from rising nonperforming loans, slow deposit growth and low liquidity, according to an International Monetary Fund report released this week.

If the situation deteriorates, some banks could be unable to meet the government's minimum capital requirements, the report says.

"The global financial crisis has exposed vulnerabilities among Cambodia's banks and is beginning to affect their financial soundness," it says.

The annual economic review adds that poor compliance with reporting rules could mean Cambodian banks are even worse off than thought.

The IMF assessment adds to warnings that the global financial crisis is spreading to Cambodia's banking industry - a sector that until recently was seen as a pillar of stability amidst falling garment exports and dwindling tourist arrivals.

It follows last week's annual World Bank report that also raised concerns about the Cambodian financial sector.

More supervision needed

The IMF's resident representative for Cambodia said the report highlighted the risks that Cambodian banks face in 2009 but did not serve as a negative forecast for the sector.

But John Nelmes told the Post Wednesday the report was a warning the National Bank of Cambodia (NBC) needed to watch closely the sector in 2009.

"There is a real need for the NBC to supervise these banks," he said.

"[The NBC] has got to be the first line of defence. ... In that sense, that's where we really need to see careful work. The NBC has to increase surveillance of the banking sector," he said. He added that the IMF noted improvements in NBC monitoring last year.

Nelmes stressed that although liquidity was a growing concern and local banks faced the double hit of falling deposits and declining foreign capital, the IMF did not "expect [Cambodian] banks to run into trouble [in 2009]".

An extreme scenario illustrated by the IMF shows non-performing loans rising to a startling 13 percent, with six banks falling short of the government's risk-weighted capital ratio of 15 percent.

Falling property prices have also put pressure on the sector, the report says. "Large withdrawals have reportedly been made by firms concentrated in the property sector, notably Korean-owned banks."

John Brinsden, vice chairman of ACLEDA Bank, said his bank's deposits have been stable.

"I think that liquidity is very tight [in the banking sector as a whole], and deposits have fallen by about one-sixth ... ACLEDA's deposits have remained steady." ACLEDA is one of the few banks that has expanded recently by increasing its ATM coverage and launching new branches in Laos.

Both the IMF and World Bank warned that a number of banks were especially at risk.

The IMF report says "several large [banks] could face a large deterioration in credit quality and a need for recapitalisation, depending on the magnitude of the current slowdown".

The World Bank report mentions "two large banks" being at risk from nonperforming loans.

Spokesmen for the IMF and the World Bank would not name the banks in question, but industry sources have identified Canadia and Vattanac Bank as of particular concern.

"These banks are believed to be overexposed to the property sector," one anonymous source said. "We are also watching a couple of others."

But Charles Vann, deputy general manager of Canadia Bank, said finances remained solid. "These are just rumours. As far as I know, Canadia's finances remain strong."

He said that the bank's liquidity and deposits been steady over the past three months.

Vattanac Bank would not respond to requests for comment.

Cambodia's banks are under threat from rising nonperforming loans, slow deposit growth and low liquidity, according to an International Monetary Fund report released this week.

If the situation deteriorates, some banks could be unable to meet the government's minimum capital requirements, the report says.

"The global financial crisis has exposed vulnerabilities among Cambodia's banks and is beginning to affect their financial soundness," it says.

The annual economic review adds that poor compliance with reporting rules could mean Cambodian banks are even worse off than thought.

The IMF assessment adds to warnings that the global financial crisis is spreading to Cambodia's banking industry - a sector that until recently was seen as a pillar of stability amidst falling garment exports and dwindling tourist arrivals.

It follows last week's annual World Bank report that also raised concerns about the Cambodian financial sector.

More supervision needed

The IMF's resident representative for Cambodia said the report highlighted the risks that Cambodian banks face in 2009 but did not serve as a negative forecast for the sector.

But John Nelmes told the Post Wednesday the report was a warning the National Bank of Cambodia (NBC) needed to watch closely the sector in 2009.

"There is a real need for the NBC to supervise these banks," he said.

"[The NBC] has got to be the first line of defence. ... In that sense, that's where we really need to see careful work. The NBC has to increase surveillance of the banking sector," he said. He added that the IMF noted improvements in NBC monitoring last year.

Nelmes stressed that although liquidity was a growing concern and local banks faced the double hit of falling deposits and declining foreign capital, the IMF did not "expect [Cambodian] banks to run into trouble [in 2009]".

"There is a real need for the national bank ... to supervise these banks."The report says liquidity shortages have arisen at some banks. "In response, banks have been raising deposit rates, drawing excess reserves and, in a few cases, borrowing from abroad," it says.

An extreme scenario illustrated by the IMF shows non-performing loans rising to a startling 13 percent, with six banks falling short of the government's risk-weighted capital ratio of 15 percent.

Falling property prices have also put pressure on the sector, the report says. "Large withdrawals have reportedly been made by firms concentrated in the property sector, notably Korean-owned banks."

John Brinsden, vice chairman of ACLEDA Bank, said his bank's deposits have been stable.

"I think that liquidity is very tight [in the banking sector as a whole], and deposits have fallen by about one-sixth ... ACLEDA's deposits have remained steady." ACLEDA is one of the few banks that has expanded recently by increasing its ATM coverage and launching new branches in Laos.

Both the IMF and World Bank warned that a number of banks were especially at risk.

The IMF report says "several large [banks] could face a large deterioration in credit quality and a need for recapitalisation, depending on the magnitude of the current slowdown".

The World Bank report mentions "two large banks" being at risk from nonperforming loans.

Spokesmen for the IMF and the World Bank would not name the banks in question, but industry sources have identified Canadia and Vattanac Bank as of particular concern.

"These banks are believed to be overexposed to the property sector," one anonymous source said. "We are also watching a couple of others."

But Charles Vann, deputy general manager of Canadia Bank, said finances remained solid. "These are just rumours. As far as I know, Canadia's finances remain strong."

He said that the bank's liquidity and deposits been steady over the past three months.

Vattanac Bank would not respond to requests for comment.

8 comments:

DO YOU STILL WANT TO OPEN THE STOCK EXCHANGE, MR. PRIME MINISTER?

CLEAN UP YOUR SHIT FIRST, STARTING FROM YOUR VERY FAMILIES AND FRIENDS.

MR. PRIME MINISTER, ALL OF YOU DESERVED TO BE BEHEADED FOR YOUR IGNORANCE AND ARROGANCE.

which banks are getting worse? I will tell mr unsuccessfully political adviser, kim vien, to Sam raingsy party, to rannarid party, and to funcipec party (keo puth raksmei) to withdraw all his money before his new wedding's day which is dating on 15-February 2009. Cheer mr youn Kim vien for betraying and cheating everyone well.

This is nothing in comparison to the corrupted bank in the US that cost the taxpayer in hundreds of billions.

Coparer le cambodge avec des pays dits développes c'est non sens Certe la crise touche tous les pays industrialises mais le cambodge a produit tres peu de chose si la BIRD et le FMI coupent les aides Le cambodghe sera en faillite et la boucle est boouclée VENDRE le cambodge à notre GRAND FRERE VIETNAMIEN pour 1$ symbolique Le cambodge aura du etre une plaque tournant financier depuis tres tres longtemps mais apres l'indépendance Samdach a passé son temps à draguer tous les femmes exemple la vraie fausse khmere monique à faire des films à faire des malins pratiquer la politique à courte vue Voila les faits et qu'on ne vient pas brandir la grande réalisation sous mon regne et a passé le clair de son temps a composé la musique que personne n'écoute au lieu de donner et favosirer la jeunesse khmere ect ect la liste est longue , je suis le premier victime à tomber dans ses démaguogie Ah ces temps qui passe j'ai la nostalgie de tous les chansons de SINSISAMOUTH lui au moins le peuple l'aime , au lieu des plagiats des chansons de samdach TA

You CPP/Viet leech at 8:39 PM is making a very very bad comparison there..I'd say, you leech can eat shit and die now!

You CPP leech sucks and begs to suck more? You leech can eat shit and die! Where are those freaking millions and millions of dollars that are sitting in the fucking one-eyed gangster Hun Sen and his cronies's pockets coming from???

Answer me you fucking bastard HUN SEN, answer me?

"This is nothing in comparison to the corrupted bank in the US ...."

And nothing compare to the THING like you, Ah corpse 8:39 PM.

1:05 AM

This fucker is no longer a human, but, in fact, he has become a shit maggot, so don't mind him.

Post a Comment